.

Your Taxes Have To Be Filed In

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Let's Talk!

Call for your appointment today! Dial (937) 268-9004

A Little Over

Years In Business

More Than

Happy Tax Clients

Upwards Of

Accounting Clients

Understanding a Notice of Federal Tax Lien and What to Do About It

Neglecting to pay your taxes can lead to serious consequences, and one of the most severe repercussions is the federal government filing a legal claim against all your current and future property through a federal tax lien. In this article, we'll break down what a...

Tax Resolution and Your Finances: What is an Offer in Compromise?

Dealing with tax debt can be incredibly intimidating. It's natural to feel overwhelmed and powerless in such a situation, but it's important not to let fear and helplessness paralyze you. Every day you delay taking action, interest and penalties continue to...

Avoid Tax Troubles: How Amended Tax Returns Can Save Your Day

Filing your tax return accurately is crucial to avoid unnecessary tax troubles. However, it's not uncommon to discover errors or overlooked information after you've already filed. Fortunately, the Internal Revenue Service (IRS) allows taxpayers to amend their returns...

Unexpected Tax Increases: Factors to Consider for Year-Round Tax Planning

Proper tax planning is a crucial aspect of financial management that should be addressed throughout the year. Waiting until April to assess your tax liability is a risky move. To ensure you keep more money in your pocket, it's essential to be aware of factors that can...

About Us

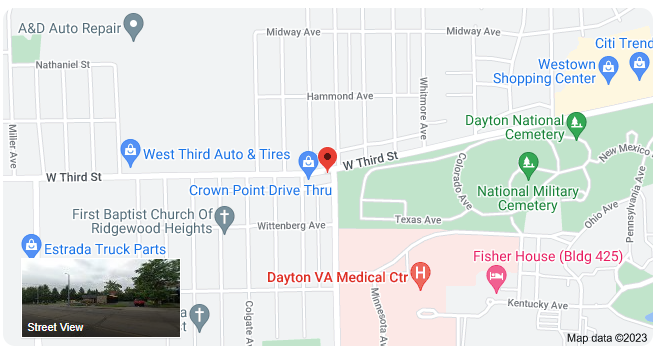

Paulette Marshall, of Liberty Accounting Plus, in Dayton, OH, started her business 40 years ago on a dare from her brother Chauncey that she was too scared to start her own tax preparation and bookkeeping practice.

Today, she specializes in helping small businesses stay out of tax trouble, health professionals and retired GM employees. She and her husband Gerald have been married for 43 wonderful years. They have 3 children and 2 grandchildren. Paulette enjoys giving back to the community by volunteering at her churches neighborhood feeding and clothing give-away program.

To schedule an initial consultation with Paulette and receive a free copy of the “Business Survival Guide,” call (937) 268-9004.