.

Your Taxes Have To Be Filed In

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Let's Talk!

Call for your appointment today! Dial (937) 268-9004

A Little Over

Years In Business

More Than

Happy Tax Clients

Upwards Of

Accounting Clients

2014 Tax Season

2014 Tax Season With the governement shut the IRS was 90% closed for the entire 16 days. Source IRS - 2014 Tax Season to Start Later Following Government Closure; IRS Sees Heavy Demand As Operations Resume The orginal start date for tax season for 2014 tax season...

Unclaimed Tax Refunds

Unclaimed Tax Refunds There are many reasons that millions of Americans don’t file their tax returns. Unclaimed Tax Refunds The main reason is fear of owing. I was talking to some tax clients who stated that they had a friend who had not filed her tax returns since...

IRS Accepts Form 4562

Starting this Sunday, February 10, 2013 the IRS will start accepting returns with Form 4562 Depreciation and Amortization. Source IRS – IRS To Accept Tax Returns with Education Credits , Depreciation Next Week “The IRS will be able to accept the...

IRS Accepting Form 8863

IRS will start accepting Form 8863 February 14, 2013 Source IRS – IRS To Accept Tax Returns with Education Credits Now many Americans can file for the tuition and education credits that were not available at the beginning of the filing season on January 30th...

About Us

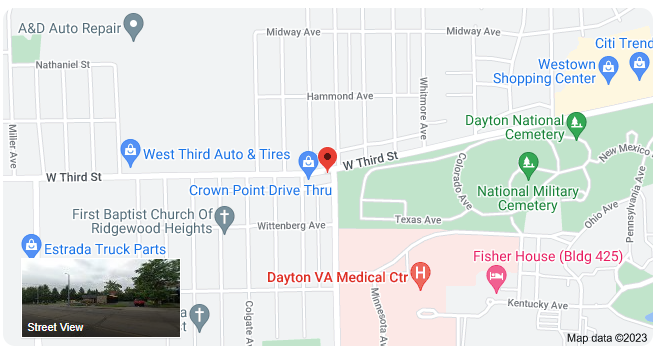

Paulette Marshall, of Liberty Accounting Plus, in Dayton, OH, started her business 40 years ago on a dare from her brother Chauncey that she was too scared to start her own tax preparation and bookkeeping practice.

Today, she specializes in helping small businesses stay out of tax trouble, health professionals and retired GM employees. She and her husband Gerald have been married for 43 wonderful years. They have 3 children and 2 grandchildren. Paulette enjoys giving back to the community by volunteering at her churches neighborhood feeding and clothing give-away program.

To schedule an initial consultation with Paulette and receive a free copy of the “Business Survival Guide,” call (937) 268-9004.