.

Your Taxes Have To Be Filed In

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Let's Talk!

Call for your appointment today! Dial (937) 268-9004

A Little Over

Years In Business

More Than

Happy Tax Clients

Upwards Of

Accounting Clients

2015 Tax Season Date

The 2015 tax season date will be January 20, 2015. "WASHINGTON -- Following the passage of the extenders legislation, the Internal Revenue Service announced today it anticipates opening the 2015 filing season as scheduled in January." Source IRS - Tax Season Opens As...

Reference 1121

Currently the IRS is having a glitch with the Where Is My Refund site. A few taxpayers are receiving a message with a Reference 1121. Source IRS :IRS Statement on 1121 If you receive the message with Reference 1121 continue to check back with Where Is My Refund. There...

2014 Tax Season Date

2014 tax season date is January 31, 2014. Tax season will start later this year due to the 16 day government shut down. The fastest way to receive your refund is through e-file. Source IRS - 2014 Tax Season to Open Jan. 31; e-file and Free File Can Speed Refunds "The...

Sign of a Lousy Tax Preparer

Signs of a Lousy Tax Preparer It's almost that time of year again. The 2014 tax filing season will be here before you know it. I wanted to share some tips with you regarding finding a tax preparer. I came across an article that I wanted to share about signs of a lousy...

About Us

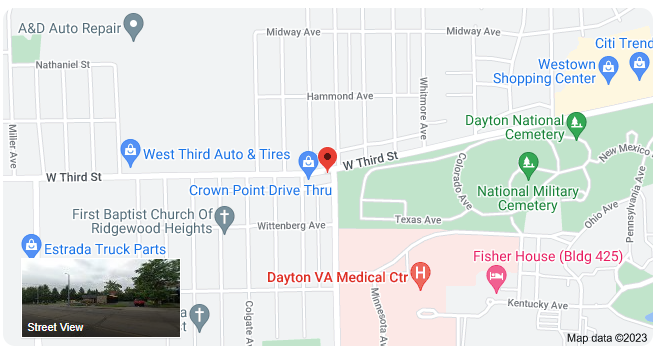

Paulette Marshall, of Liberty Accounting Plus, in Dayton, OH, started her business 40 years ago on a dare from her brother Chauncey that she was too scared to start her own tax preparation and bookkeeping practice.

Today, she specializes in helping small businesses stay out of tax trouble, health professionals and retired GM employees. She and her husband Gerald have been married for 43 wonderful years. They have 3 children and 2 grandchildren. Paulette enjoys giving back to the community by volunteering at her churches neighborhood feeding and clothing give-away program.

To schedule an initial consultation with Paulette and receive a free copy of the “Business Survival Guide,” call (937) 268-9004.