.

Your Taxes Have To Be Filed In

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Let's Talk!

Call for your appointment today! Dial (937) 268-9004

A Little Over

Years In Business

More Than

Happy Tax Clients

Upwards Of

Accounting Clients

ID Quiz

This year the Ohio Department of Taxation is offering random taxpayers ID Quiz to verify their identity to receive tax refunds. "The online quiz will give people five minutes to answer four questions that are designed so no one else would know the answer. You’ll need...

Phone Scam

Many people are afraid of the IRS. There are criminals who are taking advantage of this fear. “These callers may demand money or may say you have a refund due and try to trick you into sharing private information. These con artists can sound convincing when they call....

Affordable Care Act

The Affordable Care Act (ACA) and its Possible Effects on You and Your Tax Return We know you have a choice when choosing a tax professional, and we want to thank you for your business! We wanted inform you how the Affordable Care Act (ACA), sometimes also...

Direct Deposit Limits

This year there will be some changes to the number of direct deposits one account can accept from the IRS. Source IRS - Direct Deposit Limits "In an effort to combat fraud and identity theft, new IRS procedures effective January 2015 will limit the number of refunds...

About Us

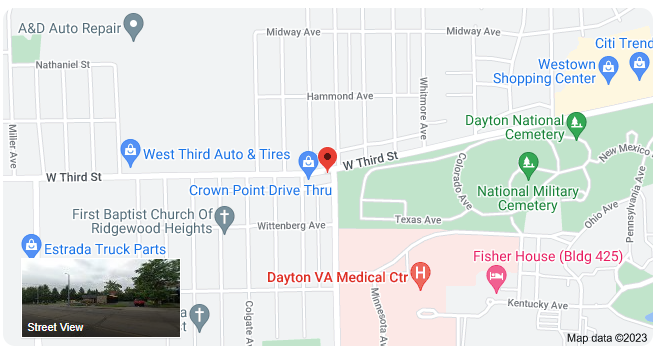

Paulette Marshall, of Liberty Accounting Plus, in Dayton, OH, started her business 40 years ago on a dare from her brother Chauncey that she was too scared to start her own tax preparation and bookkeeping practice.

Today, she specializes in helping small businesses stay out of tax trouble, health professionals and retired GM employees. She and her husband Gerald have been married for 43 wonderful years. They have 3 children and 2 grandchildren. Paulette enjoys giving back to the community by volunteering at her churches neighborhood feeding and clothing give-away program.

To schedule an initial consultation with Paulette and receive a free copy of the “Business Survival Guide,” call (937) 268-9004.