.

Your Taxes Have To Be Filed In

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Let's Talk!

Call for your appointment today! Dial (937) 268-9004

A Little Over

Years In Business

More Than

Happy Tax Clients

Upwards Of

Accounting Clients

What Happens When You Owe Payroll Taxes as a Small Business Owner

If you’re a small business owner behind on payroll taxes, you’re not alone. Most fall behind due to cash-flow issues or tough decisions made under pressure. But payroll tax debt escalates quickly. Because payroll taxes include money withheld from employees—“trust...

Partial Payment Installment Agreements: A Middle Ground for Tax Debt

When you fall behind on your taxes, the notices, penalties, and IRS pressure can escalate fast. A financial setback, medical issue, or unexpected emergency is often all it takes to get behind—and once collections start, many taxpayers feel they have nowhere to turn....

Tax Resolution Tips for Gig Workers and Independent Contractors

The gig economy has exploded. Millions now earn income by driving for Uber, delivering for Instacart, freelancing, or consulting. Flexibility is great, but when tax season hits, that freedom can cost you. Unlike W-2 employees, gig workers don’t have taxes withheld....

Innocent Spouse Relief: Protecting Yourself from a Spouse’s Tax Debt

When you file a joint tax return with your spouse, you’re both saying to the IRS: We’re in this together. That means both of you are jointly and severally liable for any tax owed—even if the unpaid balance, errors, or fraud were entirely your spouse’s doing. It’s one...

About Us

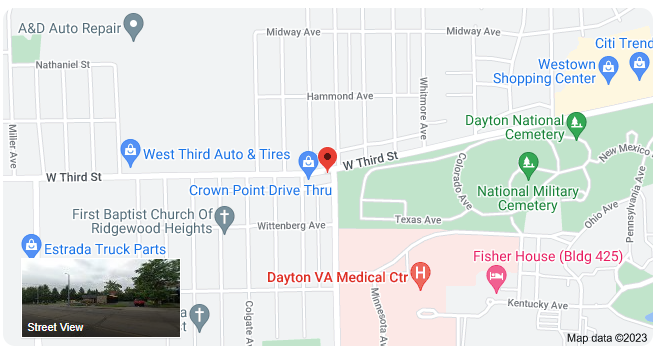

Paulette Marshall, of Liberty Accounting Plus, in Dayton, OH, started her business 40 years ago on a dare from her brother Chauncey that she was too scared to start her own tax preparation and bookkeeping practice.

Today, she specializes in helping small businesses stay out of tax trouble, health professionals and retired GM employees. She and her husband Gerald have been married for 43 wonderful years. They have 3 children and 2 grandchildren. Paulette enjoys giving back to the community by volunteering at her churches neighborhood feeding and clothing give-away program.

To schedule an initial consultation with Paulette and receive a free copy of the “Business Survival Guide,” call (937) 268-9004.